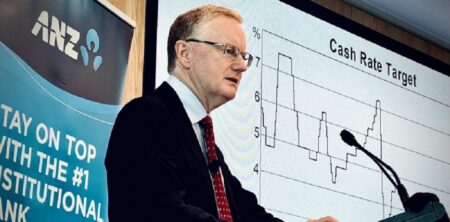

FIRST up, journalists call it the cash rate, the Reserve Bank calls it the cash rate target.

There’s a good reason for this. Journalists like short terms, and most also don’t really know how the cash rate works, so why call it the cash rate target?

The Reserve Bank uses cash rate target because its officials like precise terms.

We’ll get to what ‘target’ means, and how it influences your term deposit rate.

The cash rate (CPSA is siding with the journalists) applies when banks make payments to each other using Exchange Settlement accounts they hold with the Reserve Bank. This is done at the end of each working day.

At that point, some banks will be short of cash, some will have surplus cash. The former therefore need an overnight loan, the latter need to lend out their surplus overnight. They do their lending and borrowing amongst themselves where they can, but if needed they can ask the Reserve Bank to step in as a lender or as a borrower.

Mind you, an overnight loan may sound a bit petty, but with the sums involved it’s anything but.

To make the cash rate target work, the Reserve Bank will take a deposit from a bank at the cash rate target less one-tenth of a percent. So, with a cash rate of now 1.85 per cent, the Reserve Bank will pay a depositing bank 1.75 per cent in interest rate.

Naturally, no bank with surplus overnight cash is going to deposit any of this money with another bank for less than 1.75 per cent. If other banks are offering a lower rate, the bank with a surplus will deposit with the Reserve Bank, thank you very much.

The Reserve Bank also lends money if necessary and does so at the cash rate plus a quarter of a percent. So, with a cash rate of 1.85 per cent, the Reserve Bank will lend at 2.1 per cent.

As a consequence, no bank with a cash shortfall is going to borrow from another bank at a rate higher than 2.1 per cent, because the Reserve Bank undercuts any rate higher than 2.1 per cent.

The term for this arrangement is known as the ‘policy interest rate corridor’, currently with 1.75 per cent ‘floor’ and a 2.1 per cent ‘ceiling’. All lending and borrowing happens within the range of 1.75 per cent and 2.1 per cent.

Historically and statistically, lending and borrowing overwhelmingly occurs at the cash rate target, currently 1.85 per cent. Where that doesn’t happen, the rate agreed on is not far off the cash rate target.

Note that while all this lending and borrowing is for exchange settlements only, the cash rate target represents the cost price of money generally to banks.

Banks must source their own funds for operations such as providing mortgages. Banks have many sources, and one of those sources is the term deposit. A term deposit is what you lend the bank. Subject to fluctuations, term deposits account for about 20 per cent of the funds bank lend to people buying real estate who take out a mortgage.

That’s one good reason why your term deposit rate tracks firmly below the variable mortgage rate.

Also, the demand for mortgages from home buyers tends to go down as the cash rate goes up, so banks have an incentive to think carefully before they increase their mortgage rates. At the same time, that’s an incentive not to automatically increase term deposit rates.

In fact, if the banks pass on some or all of the cash rate increase to mortgage holders, the demand for mortgages is likely to drop, which eats into their profits. One way of maintaining profit margins is by increasing term deposits not at all or by very little.

After the previous two cash rate target increases, which the banks passed on in full, mortgage lending fell by 4.4 per cent, according to the Reserve Bank.

But it’s got to be said: some banks, particularly the Big Four, have a tendency to take the loyalty of their customers for granted.

The banks bank on your reluctance to take your business elsewhere, especially to an online bank, which does not have branches and where you take out your term deposit without ever speaking to a real person.

Overcome your reluctance, give your Big Four bank the boot, and you’ll get better rates.

Why not sign up to our free weekly newsletter? Or drop us a line and tell us your thoughts!