Some Members of the Senate have announced plans to push the Australian Government to reform tax concessions for investment properties.

This plan has the potential to raise $6 billion a year, which could be put towards funding solutions to the housing crisis.

Sounds pretty good, right? At least for those people without extra houses to worry about.

For the few that do own an investment property, they have no need to worry as the proposed options are all ‘grandfathered’, which just means that existing investors will be unaffected by the proposed changes.

A refresher on capital gains tax and negative gearing

Capital gains tax (CGT) is tax on profit from the sale of assets, which can be offset by ‘capital losses’ from assets that have been sold for less than you paid for them. Capital losses can carry over from previous years.

Negative gearing is when an investor offsets income tax by reporting a loss on an investment.

So, if a person made $50,000 in rent on an investment property but spent $60,000 on expenses such as paying down interest on a mortgage, insurance, council rates, maintenance costs and agent fees, they get to knock that off their taxable income for the year.

Meanwhile, they’re sitting on an asset that is very likely to increase in value. If not, they can report a capital gains loss and avoid paying CGT on future investments. Phew!

This wouldn’t be as enticing for people on the lower end of the wealth scale, but for people who are paying a higher marginal tax rate and have money in the bank? Well, why not. Especially if they have a creative financial manager on their side.

What are the options?

The Parliamentary Budget Office has been asked to cost five options for tax reform. The most radical option would raise $60 billion over a decade.

One option is that the current 50 per cent capital gains tax discount would no longer apply for new investment properties bought after July 1, though newly built homes would still attract a 25 per cent discount. Again, this is not for owner-occupied homes.

In essence, this proposed change would mean that people who sell an investment property would have to pay income tax on their earnings, just like everyone else. Capital losses would not be affected.

Another feature of this proposal is that negative gearing would only apply to an investor’s first property.

All-in-all, the proposed changes would raise $16 billion for the Budget by 2033-34.

Some 2.4 million people claimed $48.1 billion of rental deductions in 2020-21. Almost half recorded a rental loss for the year, meaning the income did not cover the costs of running the property.

These negatively geared investors claimed rental losses of $7.8 billion, providing a tax benefit of $2.7 billion in 2020-21.

The CGT discount is estimated to have saved eligible taxpayers $25.2 billion in 2022-23, with more than 80 per cent going to the top 10 per cent of taxpayers. On average, this group takes home around $2,820 per week.

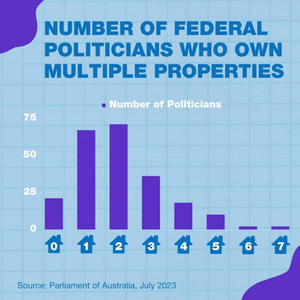

To be clear, this proposal is not aimed at ‘mum and dad’ investors who have one investment property to bolster retirement income. The point is to reduce tax breaks for very high income earners, with the aim of improving housing affordability.

Is change likely to happen?

There isn’t a lot of political appetite for reform in this area and it’s generally viewed as a poisonous issue.

Regardless of the outcome of this particular push for change, it is clear that the dire state of housing affordability in Australia will require a serious shift.

For things to be fairer, something has to give. It seems reasonable to expect that the solution may be to adjust taxation so that that there is less profit to be made from owning multiple properties when many can’t afford a place to live at all.