Remember the forgotten pension indexation method: wages!

Pension indexation is always disappointing but there is actually a method of indexation that wasn't, and it was based on improving wages.

AT the next indexation of the pension in September 2023, it will be almost fifteen years ago since the average weekly wage was used as the basis for calculating the indexation amount.

Why is this important?

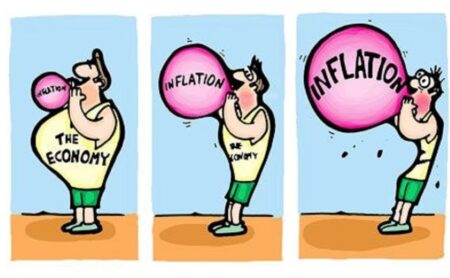

Pension indexation on the basis of wage increases is the only way in which the pension becomes worth more. Indexation on the basis of inflation only maintains the purchasing power of the pension. That is, if you’re lucky, and CPSA says that you’re not in this previous post.

The reason we’re talking about wages and indexation is that workers covered by the 841 enterprise bargaining agreements signed in the first three months of this year received an average annualised pay rise of 3.7 per cent.

The Australian Financial review reports that this was the highest rate of increase since March 2012 and well above the 2.7 per cent average annual wage rise.

In other words, wages are on the up and up, and since the Age Pension used to be indexed to keep pace with the improving earnings of working people, this may be the beginning of the return of MTAWE, pronounced um-tah-way.

Mm what?

MTAWE is the acronym for Male Total Average Weekly Earnings.

People who went on the Age Pension in 2009 after MTAWE was last used are now in their 79th or 80th year and may never have heard of MTAWE. This means the majority of Age Pensioners may never have heard of MTAWE.

It was introduced in March 1998. It was used in more than half the indexations for the next eleven years, falling into a coma after March 2009. Never used since.

Pension indexation uses inflation (the Consumer Price Index, or CPI) as the first indexation mechanism. This is then compared with a second measure of inflation, the Pensioner and Beneficiary Cost of Living Index (PBLCI). The higher of the two wins. But whichever is applied, it only maintains the pension’s purchasing power at best.

The new pension amount that rolls out of CPI/PBLCI is then compared with MTAWE. If MTAWE is higher, then MTAWE wins, but MTAWE is currently doing even worse than the NSW Blues in State of Origin.

However, the 3.7 per cent wage rise gives some hope that MTAWE may catch up one day and be used in pension indexation again.

As mentioned, after the Department of Social Services has calculated the pension indexation amounts using CPI and PBLCI, it then compares those amounts with the MTAWE pension rate.

This rate is the couple’s combined rate of the full pension, which is 41.76 per cent of MTAWE. The single rate is 66.33 per cent of the 41.76 per cent couple’s combined rate.

All these weird percentages came about as a result of the one-off increase to the single pension back in 2009. There’s reason in this madness, but we’ll discuss that another day.

The actual current basic rate (excluding the pension supplement of $118.20 and the Energy Supplement of $21.20) of the couple’s combined Age Pension is $1,464.60 per fortnight.

But 41.76 per cent of MTAWE only gets the couple’s pension up to $1,354.03 per fortnight.

A shortfall of $110.

MTAWE will have to increase by 8.2 per cent before covering that shortfall.

8.2 per cent is more than double the 3.7 per cent we talked about earlier.

At the same time the Reserve Bank is hellbent on reducing inflation by raising interest rates, which tends to cause unemployment. Higher unemployment means wage stagnation. It means no pension indexation on the basis of wages.

Still, green shoots.