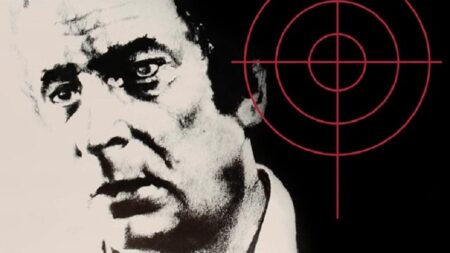

No, it’s not a new spy thriller by Robert Ludlum. It’s a document which requires each super fund to have a strategy that says how they will assist their retired members in using their super savings in retirement.

If you thought funds would have that all worked out already, think again: funds have a year to write their strategy.

The Australian Prudential and Regulatory Authority (APRA) wrote to all super funds back in March to tell them how to write their strategy.

Every day CPSA speaks to retired people who do not know how to handle their super. Most of those who call are not aware they have a problem, but from what they say it is obvious they do. Most will say that they take the minimum out of their super each year to make sure that they won’t run out of money. Most will eventually die with sizable unspent savings they could have used to make their retirement more enjoyable.

The Retirement Income Covenant can do a lot of good, but it depends on your super fund, and whether they are prepared to act in the spirit of the Covenant.

It is easier for them not to, so that is what will most likely happen: nothing.

What superannuation funds should really be doing is to sit down with each member and decide how they are going to withdraw their savings once they retire. And that should happen before members retire, not after.

In most developed countries, superannuation funds offer pension plans to their members while those members are still working. In that way, members know what they are saving for and how they can use those savings when they retire.

It’s why superannuation funds are called pension funds in those countries.

Australia is only slowly getting there, and that’s putting it optimistically. APRA writes in its March 2022 letter to funds:

The covenant does not specifically require [super funds] to develop or offer retirement income products. However, APRA and ASIC expect [super funds] will consider whether to make changes to any existing retirement income product offerings, including whether to offer products external to the [super fund’s] own products, in the context of their specific circumstances.

So, APRA specifically writes to Australian pension (super) funds to specifically tell them they don’t have to offer pensions to their members, when offering pensions is the most important thing they can do for their members!

Funds, says APRA, must consider making changes to their “existing retirement income offerings”.

With one or two exceptions, funds offer “existing retirement income offerings” in the form of so-called ‘account-based’ pensions.

These operate essentially like cash bank accounts.

A retiree wanting to make a withdrawal has to cash in ‘units’. A unit in a superannuation fund represents the dollar value of what the fund is invested in. So, a fund may own shares, real estate, bonds and cash. Add up the value of all those assets, divide them by the number of units a fund has issued, and you get the value of a single unit. The value of a unit varies from day to day. If the market is up, a unit may be worth $2.50. If the market is down, a unit may be worth $2.

If you want to get your groceries on a day the stock market is down, they’ll cost you a whole lot more.

It’s that crude, and calling an account-based pension a pension is a deception. It’s a deception that APRA and ASIC appear to be quite happy with.

Why not sign up to our free weekly newsletter? Or drop us a line and tell us your thoughts!