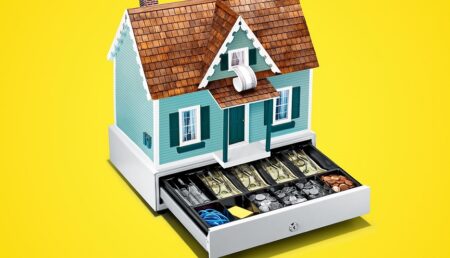

All you need to know about the Government’s reverse mortgage

ON 1 January this year, the Government’s old Pension Loans Scheme was renamed the Home Equity Release Scheme.

On that date, the Scheme started to take on all comers of pension age. Previously you had to be a pensioner, now you only have to be eligible for a pension. Hence the name change.

Now you can be a billionaire of pension age, and the Government will lend you money against any real estate you own or own through a trust.

While there are a few important differences, what the Home Equity Release Scheme really is, is a reverse mortgage.

A reverse mortgage is like the steam train in the old Marx Brothers movie Go West, where the engine (mortgage) is kept going by using the timber (interest) obtained from chopping up the wooden passenger carriages.

There are no repayments and interest is charged against the home, to be paid when the home is sold in most cases. It comes with a no-negative-equity guarantee, meaning you can’t be evicted in case the accumulated interest exceeds the value of the home.

The difference between ‘regular’ reverse mortgages and the Government’s reverse mortgage is twofold.

One, the Government’s interest rate is lower than the ‘regular’ interest rate. This means it takes longer for the interest to gobble up the equity in your home.

Two, the amount the Government is prepared to lend you is limited. If you are a full rate pensioner the maximum loan is 50 per cent of the pension-plus-supplements, taken fortnightly as a (tax-free) top up or as an annual lump sum.

So, a single full rate pensioner (on $987.60 a fortnight) can borrow a top-up of $493.80 a fortnight, or a twelve-month lump sum of $12,838.80.

A billionaire eligible for the pension (but not getting it!) can borrow $987.60 plus $493.80 a fortnight, a total of $1,481.40 a fortnight. Or they can borrow a $38,516.40 twelve-month lump sum.

Over the years, you can only borrow up to a certain overall level, dependent on the value of your real estate.

The lump sum option will be available from 1 July 2022.

For any reverse mortgage, note that a lump sum loan counts as an asset for Centrelink, although a maximum of $40,000 is exempt for 90 days.

If you spend your lump sum on, say, a car, it will add to your Centrelink-assessed assets, but spend it on a new roof for the family home, and it won’t be.

Money borrowed regularly as an income stream, would be unlikely to affect your pension. It is not subject to the income test.

Funds that are set aside by the reverse mortgage provider are not assessed under either the income or the assets test.

Now for the warning!

Taking out a reverse mortgage establishes a lien on your home. When your house is sold, this means that the mortgagee (the reverse mortgage provider) is paid what they are owed before anyone else gets their hands on the proceeds, including you yourself.

This can make it very difficult to sell up and buy elsewhere, even if your circumstances demand you move. Check out this CPSA publication on why you may find you have to move.

This makes the decision to take out a reverse mortgage a momentous decision. Don’t take it lightly!

But it may sometimes be the best solution. For example, if you enter retirement and still have a regular mortgage and have to make mortgage repayments, it can be a solution to refinance and replace your regular mortgage with a reverse mortgage.

And if you’ve got a reverse mortgage already and your home has gone up in value, you may be able to borrow some more. Heck, you are stuck anyway!

The thing about reverse mortgages is that they are almost impossible to get rid of. Once you have one, you’ll always have one.

Reverse mortgages tend be irreversible.

Unless you are a billionaire, of course, but then you wouldn’t need a reverse mortgage in the first place, would you?

Why not sign up to our free weekly newsletter? Or drop us a line and tell us your thoughts!